“We had a fairly solid vision of what we wanted this company to be,” he said, adding that he had built a previous start-up by selling software to small businesses and knew he could find strong demand in that market. But the investors did not agree. “Many V. C.’s just follow the leader, and for a time it was in vogue to just fund consumer-based plays.”

Thursday, January 29, 2009

Fund Rasing

Monday, January 26, 2009

Unproductive Productivity

A lawyer at the New York office of an international firm wanted to give the impression he was working late at night — but he was stymied by office lighting that would dim when he left the room. So he brought in an oscillating fan, which tricked the motion detectors into keeping the lights on long after he’d departed.Productivity is a strange thing; less people theoretically doing more in less time. Productivity in hotels was (at best) a rough science calculated on the amount of guests actually in house, but failing to account for the increased work demands associated with more guests checking in and out. Productivity in creative fields? Forget about it, right. Who knows? Midweek internet surfing could produce the next great ad campaign (Might not be suitable for work):

Productivity is so often reported as a flat number, but it is so obviously not a flat idea. Does merely being "present" for 18 hour days constitute productive? The Japanese may think so (just don't ask for overtime worked vs overtime paid statistics). In retail or service industries where customers might come in waves, how to do businesses staff and stay lean without sacrificing customer experience when people do arrive in mass? It begs the contradictory question: Should customers expect to spend their increasingly scarce dollars on goods that are provided through poorer service?

It seems, though, that often we are all engaged in a happy farce. From the NY Piece:

“You don’t want anyone from corporate to walk in and see you doing nothing,” Ms. Bailey said. “You’ve got to keep busy for them and the clients. You have to be proactive —” she broke off to reposition a handsome pair of boots, “so we’ll do a lot of refolding and dusting. Hey, I might just mop!”Wonder if they'll get rid of the janitor next? Like everything thing in business it is a balancing act, but it leaves one to wonder if, eventually, there will be anyone left at all?

Credit Default Swap Resolution

Wouldn't this also create a reverse market as well? They'd be like 3 year bonds that could be traded and rated based on the health of the originator of the swap...Mr. Raynes’s resolution is more radical: unwinding all outstanding credit-default swaps through a process he calls inversion.

Under this plan, insurance premiums would be refunded to buyers of credit protection from the entity that wrote the initial contract. And the seller would no longer be under any obligation to pay if a default occurred.

The premium repayments would be made over the same period and at the same rate that they were paid out. If a contract was struck three years ago and charged quarterly premiums, the premiums would then be refunded quarterly over the next three years.

One of the funny things about the CDS market is that everyone gets so worked up about it because of the size of the market (Est: 30 Trillion $US). But the chances of payment on even a fraction of this is extremely remote. The larger problem with them is the psychological risk associated with the currently interwoven global economy; should an institution go bankrupt the carnage would not be contained to their own poor choices, but would be magnified (many times possibly) by forfeitures by CDS issuers, and then again by CDS insurers on Swaps in the orginal issuer, etc.. Seems like a freeze would help, but what is really needed is a new major bank that is decoupled from the other entities in this market and is able to operate freely without these liabilities. Hmmmm...

Yet another reason to keep on the lookout for the rise of community banks in your neighborhood. VC opportunities? We all know that there is some cash out there.

Friday, January 23, 2009

Michael Lewis Interview

When I write a long magazine piece that gets attention I feel like it's more widely read now than it was ten years ago, by a long way. In fact, it feels excessively well read. Twenty years ago I might get a couple of notes in the mail and I'd hear about it maybe at a dinner party. And that would be the end of it, and it would go away very quickly. Ten years ago it would get passed around by email, and it would seem to have a life to me that would go on a little longer. Now the blogosphere picks it up and it becomes almost like a book: it lives for months. I'm getting responses to it for months. And I don't think the journalism has gotten any better.Focusing on Value at Risk:

Lets take a bond, let's say a General Electric bond. A General Electric bond trades at some spread over treasuries. So let's say you get, I dunno, in normal times, 75 basis points over treasuries, or 100 basis points over Treasuries, over the equivalent maturity in Treasury bonds. So you get paid more investing in GE. And what does that represent? You get paid more because you're taking the risk that GE is going welsh on its debts. That the GE bond is going to default. So the bond market is already pricing the risk of owning General Electric bonds. So then these credit default swaps come along. Someone will sell you a credit default swap -- what enables the market is that it's cheaper than that 75 basis point spread -- and he's saying that in doing this he knows GE is less likely default than the bond market believes.And, turns out I don't agree with him on everything:

Why does he know that? Well, he doesn't know that. What really happened was that traders on Wall Street have the risk on their books measured by their bosses, by an abstruse formula called Value at Risk. And if you're a trader on Wall Street you will be paid more if your VaR is lower -- if you are supposedly taking less risk for any given level of profit that you generate. The firm will reward you for that.

You know, I have yet to have a financial person persuade me that there's a really useful reason for a credit default swap. I know why they exist and I know why they're used. They're mostly used as speculative instruments. And the people who are selling the insurance are mostly selling it because they don't pay a price for it until everything goes bad. They weren't judged as taking any particular risk. But I have yet to have anybody explain to me why these things are terribly useful. They might have some good use and I just haven't heard it yet, but I'm dubious.Default Swaps certainly are difficult to understand, and there is definitely risk associated with them. But they are instruments to enable investors to act on information or hedge other risks in their portfolio in a more effective and targeted way. The problems with them come from lack of accounting in risks and leverage/oversight by the people/markets who create them.

GE and Capital Crisis

G.E. said its finance arm overall should be able to earn $5 billion in 2009, despite assuming losses from bad loans totaling $10 billion mainly on credit cards in the United States, home mortgages in Britain and commercial lending to businesses.

Way back quote from Meredeth Whitney:

The U.S. credit card industry may pull back well over $2 trillion of lines over the next 18 months due to risk aversion and regulatory changes, leading to sharp declines in consumer spending, prominent banking analyst Meredith Whitney said.

They are just exposed from every possible direction.

Thursday, January 22, 2009

Wednesday, January 14, 2009

Where's the teeth, SEC?

Schapiro, who was first appointed as an SEC commissioner by Ronald Reagan in the late 1980s, has most recently presided over the FIRA —a nongovernmental regulatory agency dominated by industry participants that epitomizes the "self-regulatory" approach, according to which the financial industry is quite capable of overseeing its own affairs without interference by the state.The whole piece reminded me of this piece by Michael Lewis in the NY Times:

If the S.E.C. is to restore its credibility as an investor protection agency, it should have some experienced, respected investors (which is not the same thing as investment bankers) as commissioners. President-elect Barack Obama should nominate at least one with a notable career investing capital, and another with experience uncovering corporate misconduct. As it happens, the most critical job, chief of enforcement, now has a perfect candidate, a civic-minded former investor with firsthand experience of the S.E.C.’s ineptitude: Harry Markopolos.

Mr. Markopolos is the guy who wrote a 17 page opus to the SEC speculating exactly what Bernie Madoff was, which they proceeded to ignore. It is worth reading simply to know how just how obtuse the SEC must have been not to catch Madoff, and just how much fixing they need. But it is beyond comprehension to me that this is the first that I have heard of this appointment, and that an Obama administration would choose her. It seems a basic qualification for any would-be head of the SEC should be: If you investigated Madoff and failed to find anything wrong, than you are disqualified.

Here's my choice. Why not?

Somalian Pirates

Yeah, thats right: The Mafia! More to come on this...In 1991, the government of Somalia collapsed. Its nine million people have been teetering on starvation ever since – and the ugliest forces in the Western world have seen this as a great opportunity to steal the country's food supply and dump our nuclear waste in their seas.

Yes: nuclear waste. As soon as the government was gone, mysterious European ships started appearing off the coast of Somalia, dumping vast barrels into the ocean. The coastal population began to sicken. At first they suffered strange rashes, nausea and malformed babies. Then, after the 2005 tsunami, hundreds of the dumped and leaking barrels washed up on shore. People began to suffer from radiation sickness, and more than 300 died.

Ahmedou Ould-Abdallah, the UN envoy to Somalia, tells me: "Somebody is dumping nuclear material here. There is also lead, and heavy metals such as cadmium and mercury – you name it." Much of it can be traced back to European

hospitals and factories, who seem to be passing it on to the Italian mafia to "dispose" of cheaply.

Monday, January 12, 2009

Too Beautiful to Live

JCVD

Saturday, January 10, 2009

Please allow me to share with you how "The Secret" changed my life and in a very real and substantive way allowed me to overcome a severe crisis in my personal life. It is well known that the premise of "The Secret" is the science of attracting the things in life that you desire and need and in removing from your life those things that you don't want. Before finding this book, I knew nothing of these principles, the process of positive visualization, and had actually engaged in reckless behaviors to the point of endangering my own life and well being.It only gets better from there. Its the first review for the book. Be sure to rate it!

At age 36, I found myself in a medium security prison serving 3-5 years for destruction of government property and public intoxication. This was stiff punishment for drunkenly defecating in a mailbox but as the judge pointed out, this was my third conviction for the exact same crime. I obviously had an alcohol problem and a deep and intense disrespect for the postal system, but even more importantly I was ignoring the very fabric of our metaphysical reality and inviting destructive influences into my life.

My fourth day in prison was the first day that I was allowed in general population and while in the recreation yard I was approached by a prisoner named Marcus who calmly informed me that as a new prisoner I had been purchased by him for three packs of Winston cigarettes and 8 ounces of Pruno (prison wine).

New Shepard Fairy Poster Available

Friday, January 9, 2009

Battling Fish Sticks?

How and where not to do The Fishstick from lonelysandwich on Vimeo.

Dance Move: The Fishstick from Jenna Fox on Vimeo.

In case you're interested: Shazam says the music is Archie Bell & The Drells, Tighten Up

San Francisco Pirate Radio

From their website:

Pirate Cat Radio 87.9fm is an unlicensed low powered community radio station, broadcasting on 87.9 megahertz, to both the San Francisco Bay Area and the Los Angeles basin.And, as an added bonus, just 12 short blocks from Dave Eggers' Pirate store at 826 Valencia.

Russia

Scrappy fledgling democracy (lead by a Russian assassination survivor) must fight for independence (read: heating oil) in the midst of an international geo-political battle of modern eco-commerce against a brooding mastermind with sights in cornering the Natural Gas market in Europe as a petro-fueled crown for own imperial ambitions....Somehow, the whole thing is just so cliche to me... I'm sure it wouldn't be if I was sitting cold, at home, in Bosnia. The whole thing is very Graham Green.

Thursday, January 8, 2009

Madoff Trustee

Sony's Greek Tragedy

PS. I still haven't bought a blu-ray player despite the tantalizing existence of an even better Godfather. That says something.

Meredeth Whitney Investor's Call

From July 2007 to date, over $5 trillion worth of securities have been downgraded, but our concern here is that the pace of downgrades has only accelerated through 2008," the Oppenheimer analyst wrote in a research note dated January 6.It seems as though the banks may be holding off on lending because they are concerned about the rate of right downs on existing debt. Which explains a lot and makes a lot more sense than other ideas that I have heard that the credit freeze is due to fearful non-bank actors who are wary of any risk at the moment and constitute the majority of US lending through the bond markets. If banks are suffering write downs on their debt, than those same private equity and sovereign wealth funds HAVE TO be dealing with the same (or greater) order of losses.

Wednesday, January 7, 2009

Blue Ribbon Counsil

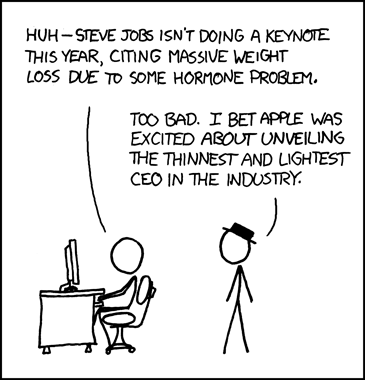

Apple without Steve; Who They Should Hire to Takeover

The entire affair reminded me of countless presentations I've been to by other execs. Apple without Steve Jobs, it seems, will be just like Microsoft or Oracle, an ordinary tech firm with perfectly adequate products and no sizzle.Not that he doesn't have trouble of his own (and who knows how little technical experience), but Apple should hire Howard Shultz to take over for Steve Jobs. It seems like what Apple needs is a consumer products guru rather than a technical leader. There is no one else, I think, that comes close to Jobs' marketing distortion field power than Shultz. It is also notable that it would let Schultz out of having to fix Starbucks, which can't be nearly as much fun as it was when he was growing it 30% a year when it started...

So there you go. You heard it from me first.

Starbuck's Union Issues

The National Labor Relations Board found on Dec. 23 that Starbucks had illegally fired three New York City baristas as it tried to squelch the union organizing effort. The 88-page ruling also says the company broke the law by giving negative job evaluations to other union supporters and prohibiting employees from discussing union issues at work. The judge ordered that the three baristas be reinstated and receive back wages. The judge also called on Starbucks to end discriminatory treatment of other pro-union workers at four Manhattan locations named in the case. The decision marks the end of an 18-month trial in New York City that pitted the ubiquitous multinational corporation against a group of twentysomething baristas who are part of the Industrial Workers of the World.I tend to be of the opinion that if workers are happy than they typically would choose not to participate in a Union. Starbucks' flexible scheduling system (along with working people just under full time) is a big reason for these problems. Here is an interview with Howard Schultz from 2004 detailing the company's Heath Care cost problems:

Without a doubt, it's health-care costs. We just had to raise our prices for the first time in four years. That is primarily because of the rising costs of health insurance and also dairy prices. Over the next two years, we will spend more for employee health-care costs than we will for coffee. That's quite a statement.Funny thing how flexible the concept of "do the right thing" can be...

The companies that are doing the right thing by covering their employees are paying for the companies who don't do the right thing. Starbucks provides health insurance for all employees working 20 hours a week and up.

Basel II

For deeper reading you can go here:

In practice, Basel II attempts to accomplish this by setting up rigorous risk and capital management requirements designed to ensure that a bank holds capital reserves appropriate to the risk the bank exposes itself to through its lending and investment practices. Generally speaking, these rules mean that the greater risk to which the bank is exposed, the greater the amount of capital the bank needs to hold to safeguard its solvency and overall economic stability.

Tuesday, January 6, 2009

Best Year in Sports Ever?

This kind of reckoning is never a science, but let's do the math: An absurdly difficult catch to ignite a Super Bowl upset plus a heart-stopping swim in the Olympics plus the gutsiest golf performance imaginable plus the greatest tennis match ever played plus....Yeah, it all adds up.Manning to Tyree.

Lezak finishing the 4 x 100.

Nadal beating Federer.

Tiger woods winning the US Open.

Pretty good year, I'll give 'em that. Wonder what this guy would have said about it?

Monday, January 5, 2009

Transition Away from Wall Street

This has been a long time in coming and seems to be something of a myth: All the bright creative people of our generation left their Ivy League schools for gold plated Wall Street and were hopeless to resist the financial rewards.“The economy couldn’t survive on speculation and what really amounted to advanced financial alchemy,” he told The Times. “We are now realizing it is our human creativity that is our real capital.

“The economic downturn is going to free up top talent to do other things that are going to change the metabolism of cities like New York in a very good way.”

I am skeptical. I wonder how much of this is willfully wishing that our best and brightest were more altruistic and bursting with something other than unaccountable greed, and how much of this pent-up creative genius actually exists? All the same, it is not like money is going away and with TARP its also not like the government wouldn't be a proud stop for altruistic financial do gooders... I just wonder how many Creatives are going to willfully turn their back on the money that will be made (in the future) now that they have tasted it?

My Call

Shorting commercial property indexes over the next six months seems like a no brainer right now. There is no question that businesses are going to tighten their staffing levels over the next two quarters as they reflect a shift to different areas of profit from the previous 12 months. Because of this it seems self evident that their reduced foot prints would create significantly broad increases in vacancy rates. I would be tempted to say that risks associated with credit shortages and defaults would already be built into the system. But, as the above chart shows, commercial real estate as a whole returned 2.5% last quarter. Indeed commercial index IYR is trading almost 33% off its lower at the end of last year.

Shorting commercial property indexes over the next six months seems like a no brainer right now. There is no question that businesses are going to tighten their staffing levels over the next two quarters as they reflect a shift to different areas of profit from the previous 12 months. Because of this it seems self evident that their reduced foot prints would create significantly broad increases in vacancy rates. I would be tempted to say that risks associated with credit shortages and defaults would already be built into the system. But, as the above chart shows, commercial real estate as a whole returned 2.5% last quarter. Indeed commercial index IYR is trading almost 33% off its lower at the end of last year.I just don't see why this index won't see a correction along the magnitude of the residential market. I am locking in a price 35.83 and we'll see where we stand in 60 days, and 90 days.

Sunday, January 4, 2009

Risk All Around

It seems a reoccuring story in this crisis that people want simple answers to complex questions, even if there is a high likelihood that those answers are wrong. How else can you describe the carnage that is our economy at present? How many of these sophisticated (ie too complex for the average person to understand) investment tools which have imploded over the last year have relied on these inclinations to facilitate their risky behavior?

For some cirticism of the article you can look at this piece that astutely points out many the technical flaws with the NY Times piece's premise, but the post also regretably looses sight of the larger issues raised in the piece for the Times' larger audience.

Our Finacial Times

He is the best writer on money anywhere that I have read and it would be worth you while to read this one too. If you haven't read the SEC report that he refers to about the Madoff mess, you can find it online. It is well worth a read to find out how obtuse the SEC must have been to ignore Madoff for so long.

Welcome to my world.