What follows are the three categories where Casual Cuisine can add to Hotel offerings (and support their bottom line):

1. The Pop-up:

The most tempting place for a hotel to dip its toe into the Casual Cuisine waters would probably be the pop-up restaurant movement best demonstrated by Ludo Bites down in LA. Chefs taking over restaurants for short stints is not an unusual thing. But the combination of the economic downturn (read: good chefs without gigs), the rise of the celebrity chef, and perpetual foodie search for the next "undiscovered treasure" should be manna from the gods to hotels with dark rooms and banquet facilities looking to generate some buzz, or provide a unique offering to guests. It should also not go unnoticed that professionally trained chefs are comfortable in formal kitchens and with (typically more formal) hotel service styles. Why not open a second restaurant once a month in dark banquet space featuring a guest chef serving some highly imaginative cuisine? Whats there to lose? You have to keep the kitchen open anyhow...

2. The Added Attraction:

All Hotels should take note of of a very successful movie night that the Good Hotel (a JDV property in San Francisco) did in conjunction with the bicycle coalition. Set aside the Green and Local appeal of this event for a moment, and focus mainly on the totally unique experience that Good Hotel was able to offer its guests:

Imagine seeing that on your first trip to San Francisco! Even better, imagine the battle hardened road warrior seeing that on his or her 50th time to San Francisco. These vendors prepared the food themselves, arrived on their own dime, and were happy for an opportunity to showcase their food. There's no reason why a hotel couldn't capitalize on this low cost event idea again with something focused on local food and local community for their guests. (Hint: It wouldn't even have to be in the hotel, how about near the hotel or in a parking lot...)

3. The "Oh My! What's is this?"

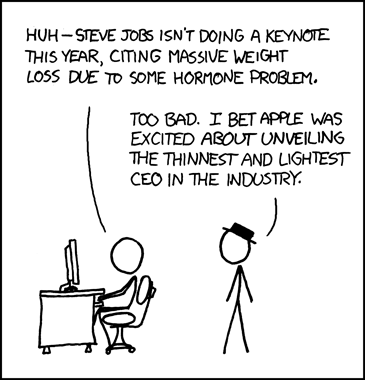

Everyone loves dim sum. The carts come around and you take something that looks good.

If something comes around that you don't like, you leave it. No problem. Something else will come along.

Tapas is the same way; small plates that keep you around to purchase the (high margin) drinks. Why couldn't a hotel allow certain mobile food vendors to come in and sell things once a week? To be sure, this isn't workable for all Hotels. But what about the ones with limited food offerings (especially late at night)? This is a home run for happy hours or theme nights. Keep the variety. Keep the soul of the food. Make it easy to manage and maintain quality. You'd have foodies searching for you from far and wide. And, if things don't work out? No problem. Easy to end.

There's something special happening with Street Food at the moment. Hotels would do well to take note and run with it. It'd serve the properties just as well as it would serve food vendors.